The cryptocurrency world was rocked by the news of one of the largest heists in its history: hackers stole a staggering $1.5 billion from the popular exchange Bybit. This incident, reported by NBC News, is a stark reminder of the vulnerabilities that still plague the crypto industry, despite its rapid growth and technological advancements. Let’s dive into what happened, what it means for the crypto ecosystem, and how users and exchanges can better protect themselves in the future.

What Happened?

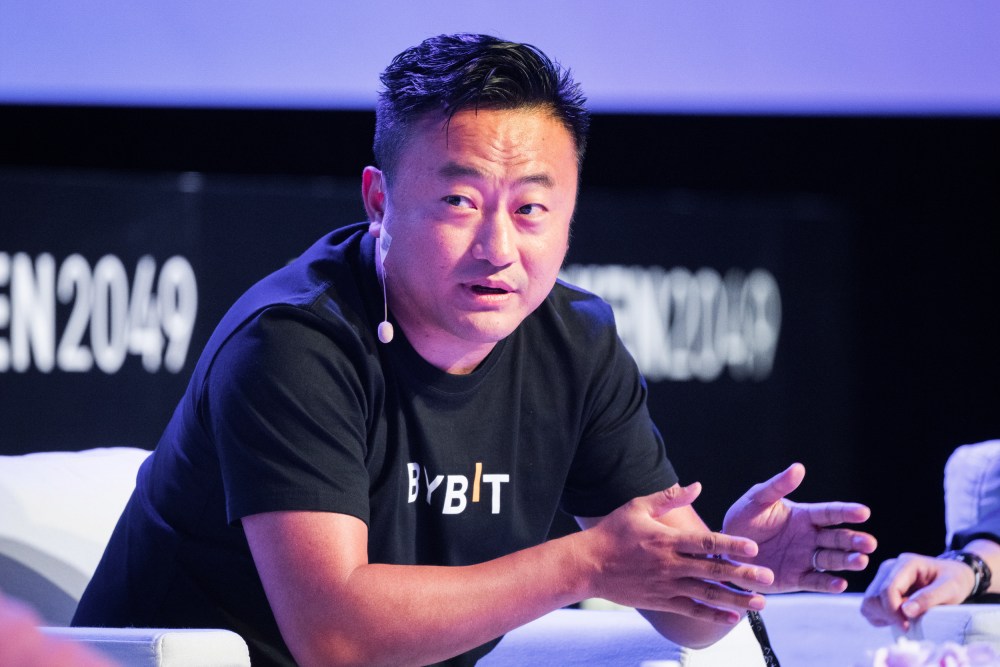

Bybit, a leading cryptocurrency exchange known for its derivatives trading platform, fell victim to a sophisticated cyberattack. Hackers exploited vulnerabilities in the exchange’s security infrastructure, making off with $1.5 billion in digital assets. While the exact method of the attack hasn’t been fully disclosed, such breaches often involve phishing, social engineering, or exploiting software flaws.

This heist is particularly alarming due to the sheer scale of the theft. It not only highlights the technical sophistication of modern hackers but also raises questions about the security measures in place at major exchanges.

The Impact on Bybit and Its Users

For Bybit, the fallout from this breach is significant. The exchange now faces a crisis of trust, as users may question the safety of their funds on the platform. Financial losses of this magnitude could also strain Bybit’s operations, potentially leading to liquidity issues or even regulatory scrutiny.

For users, the breach is a harsh reminder of the risks associated with centralized exchanges. While these platforms offer convenience and liquidity, they also represent a single point of failure. If an exchange is compromised, users’ funds are at risk—no matter how secure their personal accounts may be.

Broader Implications for the Crypto Industry

The Bybit heist is not an isolated incident. Over the years, the crypto industry has seen numerous high-profile hacks, including the infamous Mt. Gox and Coincheck breaches. These incidents underscore the ongoing challenges of securing digital assets in a rapidly evolving landscape.

Security vs. Convenience: Exchanges often prioritize user experience and speed, which can sometimes come at the expense of robust security measures. This breach is a reminder that security must remain a top priority, even if it means sacrificing some convenience.

Regulatory Scrutiny: As crypto becomes more mainstream, regulators are paying closer attention to how exchanges operate. Incidents like this could lead to stricter regulations, which may be a double-edged sword—enhancing security but potentially stifling innovation.

Decentralization as a Solution: Many in the crypto community advocate for decentralized exchanges (DEXs) as a safer alternative to centralized platforms. While DEXs are not immune to risks, they eliminate the single point of failure that makes centralized exchanges so attractive to hackers.

What Can Users Do to Protect Themselves?

While exchanges must bear the primary responsibility for securing user funds, individuals can take steps to minimize their risk:

Use Hardware Wallets: Store the majority of your crypto assets in hardware wallets, which are offline and less vulnerable to hacking.

Enable Two-Factor Authentication (2FA): Always use 2FA on your exchange accounts to add an extra layer of security.

Diversify Your Holdings: Avoid keeping all your assets on a single exchange. Spread them across multiple platforms or wallets to reduce risk.

Stay Informed: Keep up with the latest security practices and be cautious of phishing attempts or suspicious links.

What’s Next for Bybit?

Bybit has likely already launched an investigation into the breach and is working with cybersecurity experts to recover the stolen funds and strengthen its defenses. The exchange may also need to reassure its users through transparency and enhanced security measures. Whether Bybit can regain the trust of its users remains to be seen, but this incident will undoubtedly serve as a cautionary tale for the entire industry.

Final Thoughts

The $1.5 billion Bybit heist is a sobering reminder that the crypto industry is still in its infancy when it comes to security. While blockchain technology itself is highly secure, the infrastructure built around it—exchanges, wallets, and other services—remains vulnerable to attack.

For the industry to mature and gain widespread adoption, security must become a non-negotiable priority. Exchanges need to invest in cutting-edge security technologies, and users must take personal responsibility for safeguarding their assets. Only then can we hope to prevent such devastating breaches in the future.

What are your thoughts on the Bybit heist? Do you think decentralized exchanges are the answer? Share your opinions in the comments below!

Comments

Post a Comment